No-Organisation and how Data will break the hierarchy!

image source

thinking about delivering innovation, growth and sustainability by internalising the disruptors within the institution

Summary

This thought-piece is based on the experience of the author through exposure to the dynamics of corporate actions, startup funding and a little empirical research.The purpose is to present a radically new concept for a corporate structure; because there is a belief that hierarchy and structural issues are the main hurdles preventing corporates implementing truly disruptive strategies which can if implemented using this thinking deliver growth, create innovation and long term sustainability.

The title is a play on “No Logo” by Naomi Klein

Context

We continue to wrestle with an ongoing thought: How should a corporate organise itself to foster entrepreneurship and innovation? Yes, there is an implied assumption here; the belief that in order to grow, thrive and maintain relevance as an organisation, there is a need for innovation and entrepreneurship in order to become the disruptor yourself before lightweight startups overtake your space in the market. Whilst I am sure there is no all embracing solution and most of what we have advised, created and rolled out including: incubators, labs, innovation programs, entrepreneurship skills, mentoring, disruption thinking, startups engagement and even my books on it, in the main do not deliver the change that is actually required. Initiatives that are tried are realistically just playing at the edges and delivering lip service to innovation - as the existing structure will defend itself against any new form of change.Fundamentally I believe that existing corporate structures frustrate any innovation effort as there is:

- Short termism (focus on today’s task list) is the driver, which appears impossible to break

- An overriding imperative to protect personal employment strategy, which means middle management will not take risks

- A single point at the top providing command and control with centralised decision making

- Hidden agenda constraints based on priorities and the allocation of resources for self driven interests

- A belief that the exec/ senior team are better, brighter and quicker

- No data that we can trust

There are many reasons for the change of approach needed, here we focus on four: Millennials, Complexity, Exponential Growth and Data. We are ignoring here large shareholder revolts, gig contracts, the pension issues, customer power, structural education system failures, The #andme movement and many more….

Millennials entering the workplace

Millennials or digital natives are joining the working “day” (not place) and their increasing numbers and dominance is creating change. They have brought, with their presence, their own revolutionary style of communication, a different attitude to brand alignment, new ideas on the relationship to personal information and different values and passions. Many of the organisations they join are structured according to traditional rigid processes and driven by financial controls. The millennials see this old thinking in the application process, through reporting, production signoffs, software releases and even evaluations. Whilst there is an understanding by many board members to untangle the old overly process-dominated systems of management driven by a new need for agility, flexibility and mobility; however this is only part of the story.One specific issue is the middle management sponge in the hierarchical structure that don’t get this transition to a networking approach (check out team of teams) using social communities and tools. It could be argued that they don’t have the freedom to introduce new tools or equally they play safe and avoid risk. Irrespective of view, this new method of working results in a more collaborative, solutions-based work structure which yield a hierarchy that is increasingly blurry and many “middle” management roles obsolete. As a result, managerial figures are no longer in control or integrated into every project phase because the system doesn’t accommodate them in a classic capacity and their defence of this often to slow down change and adoption (self-reservation of the permafrost). The conflict is that the young employees expect a culture of networking and feedback, so organizational structures integrate more constructive evaluation and dialogue within the hierarchy, but this doesn't really recognise the real shifts. Top and middle management say they want to change the structure, but they are so stuck in and by their thinking, education, experience and personal agenda so no-one believes what they are saying.

Richard Sennett, the American culture sociologist, states that the employee of the future doesn’t need to have experience as much as a potential for gaining (digital) skills. For traditional management, the implications are even more drastic in the future company; good past performance will no longer guarantee present job relevance or security. The 80:20 rule means you only perform once or twice and if you miss that it is all rather messy.

Millennials, before even applying for a role this generation has access to far more diligence on you than you will on them from social data and networking sites. Since working is no longer a job or income for them, it has to have purpose and that purpose needs to align to their own purpose. Companies should take care not to sell to this generation a falsehood in terms of how they will be valued and rewarded, as the company's values and purpose may end up attracting the very digital skills they need and desire, but they then walk out of the door on day 2, day 5 or day 21.

There’s a lot of writing about the gig economy and at many levels it is about shifting the power of balance. But this context is not about contractual rights for gig worker; it is that the new dimension which means employees (millennials) leave for purpose reasons and not to another “job” but use the gig/ portfolio economy as a mechanism to find what they want - where they can feel useful. This is very different to the union filled issues of employment contract rights, however accessing this skilled base means that you need to do more than just enable them to survive.

Exponential growth

Do you think that Uber is disruptive or innovative?I would present the case that I believe that Uber was disruptive in marketing, is at best innovative today and has the potential to be revolutionary later. It uses the same customers and same infrastructure, but created a way to expand by reducing the costs of the infrastructure and made payment frictionless. It also reduced the randomness and often fear through dual rating. It has the potential to be the platform for autonomous vehicles’ scheduling and management , which would be truly disruptive to the auto industry as-well as transportation. As of today Uber has not lost jobs or removed margin from the industry in the same way digital has disruptively transformed photography, music, books, video, news, commerce, payment and many other industries.

The reason for the question is that innovation and disruption are often difficult to separate and may only be separated by time scales, and when the speed of change is exponential, change just arrives. As graph 1 below shows, linear with growth looks a better option for growth for the first 7 year period, then suddenly the upstarts have the economics of scale to change the margin and market dynamics. In the old world if you managed to grow a $1bn business in 8 years to $2bn you would have been a celebrated CEO - now that linear growth is not sufficient for the organisation to survive.

Reflecting on this graph, the Financial Industry started FinTech innovation in 2012 and on a time window of 8 years to disruption, it has perhaps three years before this crossover will hit hard in the form of innovation over the past 5 years. The Insurance Industry maybe 5 years away having started in 2015 - however Transportation (Uber) is still 10 years off. Healthcare is now in the crosshairs of many startup companies and given 8 years it will be a different market, however Wellness and Fitness has probably only 3 years left before something significant hits at scale. Irrespective of industry, linear is no longer strategy for survival, acquire or be acquired.

Critical here is one simple fact. Exponential is long term. Linear being short term, results now, quarterly reporting and management structures to make sure a bonus is met.

Data

Fundamentally data is eating all the models right now. Whilst data is “everything”, we currently lack the skills to understand what the data is telling us, we have the governance to know the data is what we need and what it is telling us it true, we lack the skills to turn the data intro value and we lack that concept of actually what data is. Data is Data is explored here. Data as trust is explored here. Data is not an asset and is not something that has a budget - it requires a totally different approach to controls and management, if indeed it can be controlled or managed!

-o-o-o-

Structure: strategy: style: culture

The first book I remembering reading on corporate strategy was in 1990. Goold and Campbell (1987) “Strategies and Styles”. They researched large corporations and discovered that parent companies behaved in very different ways. They examined the extent to which management styles varied along the dimensions of planning influence (i.e. the extent to which the corporate level became involved in the strategic and operating planning of the business) and control influence. Three styles seemed to stand out. Financial control companies (e.g., BTR and GE), the center allowed a high degree of strategic and operational autonomy within the underlying businesses (low planning influence). The budget, however, was sacrosanct and any slippage from planned performance needed swift correction, if it were not to mean the curtailment of the career of the responsible GM (tight financial controls). At the other end of the continuum, strategic planning companies (e.g. BP and BOC) involved themselves on an ongoing basis in the strategic planning and management of the businesses (high planning influence). But they were more flexible if performance did not meet targets. As one chief executive explained, “when a business is in trouble, controls should become more friendly not more fierce” (flexible control influence). In between these two extremes was the third style strategic control companies, such as ICI and Imperial Group.I read Geoffrey Moore’s (as in Crossing the Chasm fame) “Zones to Win” in the Winter of 2016. “A good book as it highlights the need for a different approach using zones for innovation but maintaining Business As Usual (BAU) within the existing structures but adds zones for innovation.” Peter Hinssen’s excellent book “The Day After Tomorrow” describes a wider range of newer business structures for innovation. Both books are essentially a great analysis of what exists. Then there is Rajeev Pershawria “Open Source Leadership” book, an excellent book insomuch that he spends a long time describing all the above issues with facts and figures, but does not offer anything new in terms of structure.

Whilst I continue to read widely on culture, vision, structures, controls and styles, what I now realise is that they all fundamentally have the same assumption - the hierarchy underlying the current model remains but we can change everything else. The issue is surely that this model of command and control from the top is the very problem that kills/ prevents innovation.

Could a corporate restructure itself to enable/ allow innovation and even disruption? I have come to realise that playing about round the edges with accelerators, incubators, eco-systems, garages, EIR, labs and internal venture funds does not actually change anything (structurally). It sure feels good and is very rewarding for the individuals but has no long term hope of success (yes there will always be the exception but that is why we have an increasing number of models that people try following the example of one which worked for someone else). The latest strategic fad is to divide a big company in smaller companies (AKA startup) but this makes the work for the employees really complicated and the risk adverse controllers move the interface of the different companies.

An important observation often made is that organisational structure (and the subsequent resistance to change because of the structure) is the result of important externalities such as a regulator or powerful shareholders. Regulators, and in some ways shareholders, want one responsible and accountable person at the helm (so to speak) in case anything goes wrong (who to hold accountable). This observation is compounded with the thought that whilst we know turkeys don’t vote for Christmas, why would a board agree something that will reduce their power, span of control, personal brand and influence? Innovation, entrepreneurship and disruption are at best nice to have! The current system of ignoring it does not work is self sustaining - until it falls apart.

Previous form anyone? What can you do in the face of a more agile foe?

General Stanley McChrystal, who was the commander of the US Armed Forces in Afghanistan released that command and control was not working and he could not defend his troops or fight effectively against an enemy who was organised differently. He realised that he was not fighting a structure (centralised and rigid) but a network (decentralised and agile) which could pump information and activity round far faster than he could even gather data as his hierarchy and chain of command put in too many hurdles and barriers. Immediately he saw results when he took the incredibly bold step of letting go of history and the best old, classical, historic, and passed down thinking and learnt that agile is the new normal. He has published a fantastic book on this “Team or Teams”, or watch his TED talk. The point being that, if the army can change, which is where corporates took a lot of structure their from, perhaps corporates should learn again. Time and great care must be taken as when elements of trust and transparency are broken it takes time to heal and in that period something horrid can happen in the transition.

A Thoughtful Model

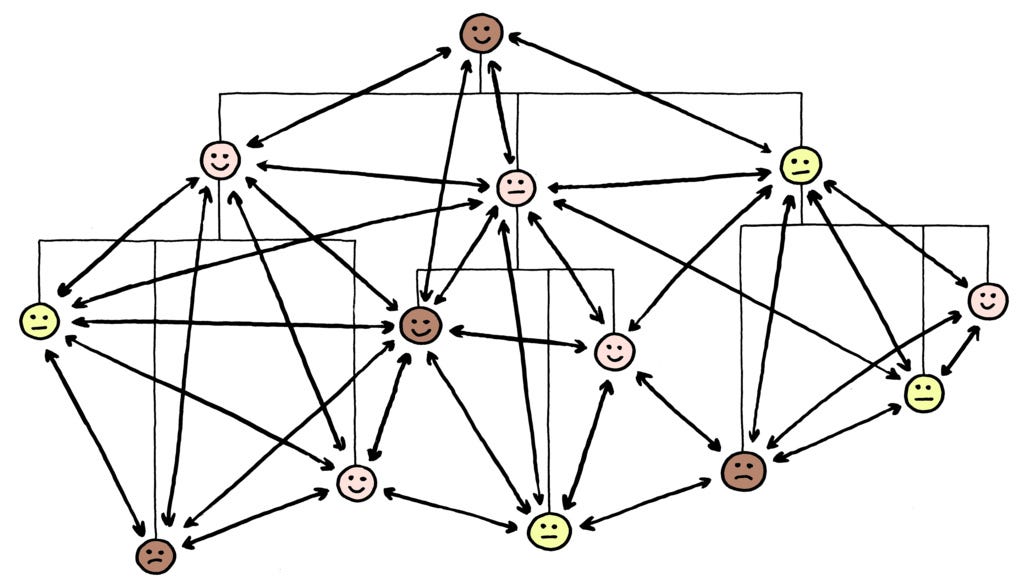

The proposal here is for an organisation which is organised into an exec team who have oversight ( responsibility and accountability) for the platform, internal services and small business operators known as 'operating cohorts'. There is no hierarchy or triangle of power control resting at a pinnacle. The exec team focus on long term and delivers governance and compliance for the platform. Each cohort survives and thrives only by merit and utilises the “platform” to deliver service to customers.

All the significant change happens at the senior exec level as all the key commercials and operational roles are pushed down to cohort level. There is no centralised strategy, finance, innovation or decision making. This is seen through the dropping of any title containing the word “Chief” Full accountability and responsibility for day to day and short term (sub 3 years) performance is given to those who manage and operate each cohort, and each of the executive committee is held accountable for a 10 year horizon group strategy, innovation and growth. A large organisation could have 10,000 cohorts.

The new board makeup

The change at board level is essentially a move from command and control to enabling the network to function. No longer pretending to be the orchestrator and delivering oversight but becoming the best facilitators and allowing value to thrive in chaos.

Old Title : Chairperson. New role :Lead on all Arbitration and Reconciliation

Lead on all Arbitration and Reconciliation. The chairman moves from figure head to a hub in a hub and spoke formation. They act as the arbitration and reconciliation person bringing about resolution and harmony. They don’t have the casting vote.

Old Title : CEO New role Director of Shareholder management

The short term leadership and day to day performance is pushed down to the heads of each division, this becomes the person who is responsible for getting and maintaining the right shareholders. They will take over some CFO responsibilities for capital structures.

Old Title : CFO New Role Head of Budget and reporting

All finance and accounting is run by divisions on the platform, this becomes one of budget responsibility and pre approved reporting publication. They will maintain treasury functions. The budget setting is only for the platform and the costs allocation, not for each division or control. All internal and external reporting is automatic

Old Title : COO New Role Head of Physical assets/ Head of security

This role is separated into three people, one leading on all physical assets, one for security (all aspects) and one who runs the platform (described later). Development work for the platform is managed from here but what is developed is specified/ required from the division who also pay for it. Operational roles are pushed to the cohorts and the head of platform will run day to day operations

Old Title : CTO New Role : Head of platform

No real role going forward as moved to head of platform

Old Title : CMO New Role : Brand ambassador

Sales and Marketing is pushed to each division but the overall brand, value, mission and vision is aligned and monitored at this admin exec committee.

Old Title HR New Role : Management of Talent

HR is pushed to divisions but this role is about acquiring and attracting new talent, training, movement of staff and which talent to lose.

Old Title CIO, CStrategyO Innovation, CPO, CxO, Services, Sales, general counsel

None at this level These functions are all pushed down to divisions and services — if required at all. Special note on the CDO as they make no sense to make one person responsible for data — this organisation is data and everyone lives and dies by it.

Board Committees : Governance, compliance and audit, trust, privacy and ethics

These becomes team with support from data and API to provide feedback and improvement across the organisation, working with regulators.

New Role : Head of internal services

This is a new role and ensures that services such as legal, banking, IT & computing, phones, finance, cash, HR, payroll, procurement are fit for purpose and deliver.

Each cohort outsources to internal services all not critical functions, internal services makes the choice who and how these are provided and manages them. The overall operating model is best overall service quality and cost provider in the market and will use both internal and external suppliers but will manage them and provide the flexibility and speed needed. Will operate at zero margin and cost recovery only without overhead or other false accounting allocation.

cohorts

I have tried carefully to avoid the word division, unit, operating business at the cohort level as they are not. Divisions are controlled, cohorts can spin freely. Cohort can offer their own propositions and run very different business models but have to use the platform. Each cohort has its own management, cohorts can compete for markets, customers and staff. Staff have the freedom of movement within the “corporate” and cohorts. Each cohort sets its own structure and operating processes. Each one lives and dies through the ability to execute, attract and service customers, cover costs and retain staff. Essentially each cohort is a business who benefits from the economics of scale for a shared platform and access to services.Each cohort can and must operate as they like, any structure, any reward with their own strategy, own team and own terms; however:

- Each cohort uses the platform to offer service and service customers

- Must use the internal services via API

- Must pay for platform, services and any physical assets utilised

- The size of each cohort is limited to 80 to 120 people or by Coase’s Theorem ( graph 2)

- Can suggest and pay for development of new platform services

- Surplus margin is not stripped out but is retained by the cohort for its own growth or reward

Graph 2 - Q = optimal size is when the min occurs when you sum transaction cost and organising cost

Core functions

Whilst the exec team are responsible and accountable for the platform business and ensure that the internal services are effective and efficient, they can concentrate on long term growth. They set the pricing for the platform as this is essentially the business. Reporting for short term financial results is fully automatic and could be done monthly. It is entirely mechanical.A subtle but key point here is about processes. The traditional thinking about end to end processes and customer journey goes out of the window. So does the thinking about making the most efficient process. Here the platform enables mirco-service. How those services are joined together via API calls is up to the cohort. The mirco-services / micro-processes will join in any way to deliver what the customer needs and give API between processes all reporting can be done. Once the corporate was the process, scale was a defence, IP sat in the process, in the new model - there is no defined ridge process.

The exec team would also decided on which core platform services could be accessed via an open API to third parties, which may compete with cohorts. Given this, the company can buy a team/ company that would create new cohorts. The exec team also own the entire data set and the analysis for the organisation. Whilst cohorts have their own data, they may be restricted from open access to all data.

Internal services are not there to make margin but to deliver efficiency at scale to power the organisation - hence the Gig economy thinking is so critical.

Implications of Organisation 2.0

Exec team

- Released all short termism to the divisions

- Reporting on short term is mechanical

- Primary reports on platform which is the margin business and separately on cohort execution which should be BE

- Top Team focus on long term and making sure that the systems are true and honest

Staff

- Offered freedom of movement

- Employment terms for the remunerated is set and controlled within a cohort - no universal pay scales

cohorts

- Self managing with own managing director.

- No rules on structure, strategy, focus, KPI or style

- Opportunity to sell/ buyout - general terms are published by the exec team as generic and there is no negotiation.

- Cannot force closure from exec team, closure is by inability to meet platform/ internal costs payment

- Can be created with budget approval but does not require exec approval

- Real cash is pooled - no separate treasury functions

Platform

- The business the corporate is now in

- Scalable and delivers the services which customers want

- Flexible, adaptive and can lose a limb

- Not dependent on a technology

- Enables and facilitates learning ML today and AI in the future

Internal Services

- Min staff to deliver service

- contractors added when needed for support

- ability to bring in/ access to specialist skills

- no margin added from costs to business

- legal, banking, IT & computing, phones, finance, cash, HR, payroll, procurement

People/ Talent

A separate follow on people